Securing your trade receivables from commercial and political risks.

Trade Credit Insurance for Bank and Financial Institutions

Financial Institutions, specialty lenders and investors use Trade Credit Insurance to protect international trade payment facilities, general corporate loans and other financial assets against default

Why use trade credit insurance

The broad applicability and flexible policy wordings offered by insurers across the world to best fit the needs of financiers, makes trade credit insurance a reliable risk mitigation technique. Some of the advantages include

- Use insurance as a qualified risk mitigant to meet with international accounting standards under Basel II/III.

- Ability to hold assets on your own books with a lesser risk weightage. This reduces the reliance on seeking risk participation from other lenders, including partial or complete sell down of assets

- Increase lending capacities with the help of management of internal obligor limits and country limit constraints.

Prowess has its finger on the pulse of the market and is able to deliver on economical solutions with the right amount of coverage for your needs. With our ability to structure policies and coverage terms, Prowess is known in the insurance world to bring forth unique arrangements. Our forte continues to be the development of the insurance world for the risk requirements of the emerging world.

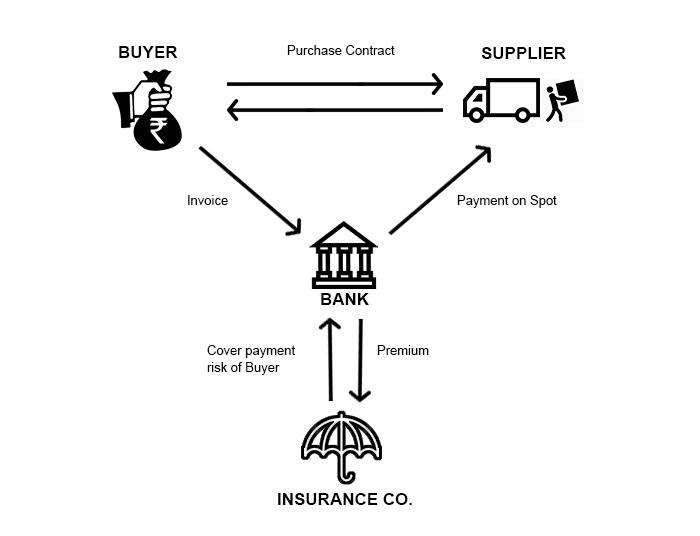

How does it work?

How can insurance help?

Bank to Bank Trade

• Letters of credit

• Bankers acceptances

• Trade acceptances (drafts)

• Trade loans (bilateral and syndications)

Trade related corporate lending

• Import and export financing (revolving facilities)

• Pre-export financing

• Purchased Accounts receivables

• Accounts Payable financing

• Foreign accounts receivables