Providing stability in an ever growing volatile world

Political Risks

What is Political Risk Insurance?

Political risk insurance provides protection against risk from political events that negatively impact investments. The risks are usually higher in the developing countries where economy or politics are unstable. Political Risk Insurance is designed for leading multinational companies, including financial institutions, exporters, investors and multilaterals.

Covers based on medium to long term projects with multiple perils covered, this insurance assists businesses in anticipating risks and assists clients prevent, anticipate, respond and ultimately recover from crisis & broader political risk exposure and events

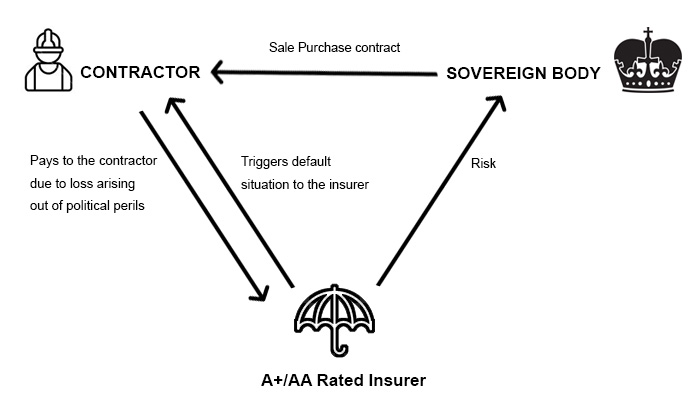

How does it work?

Be it one off contract for purchase of good and services to long termcapital intensive investment into infrastructure, the coverage provides for a combination of protection depending upon the geography, the economic conditions, past history with the Obligor, geo-political situations and future projections.

Typical purchasers of this coverage would include Banks, Contractors, Exporters, Multinational Corporations.

Product Coverage

Currency Conversion & Transfer Restrictions

Confiscation, Expropriation, Nationalization and Deprivation (CEND)

Deprivation coverage insures against the risk of a government action preventing use of the asset (such as denying a permit to run a plant).