Reducing financial losses due to outright non payment on delivered contracts

Comprehensive Non Payment Insurance

What is Non Payment Insurance?

It covers banks and other financial institutions when borrowers fail to pay back loans. While most lenders usually enter into a syndicate with other financial institutions, an insurance cover can allow the lender to take on the entire loan value without the involvement of other banks. The insurance acts as a stop-loss arrangement therefore enabling lenders to leverage the banks’ credit limit on the obligor/country/loan type and assist the bank in obtaining capital relief.

How does it work?

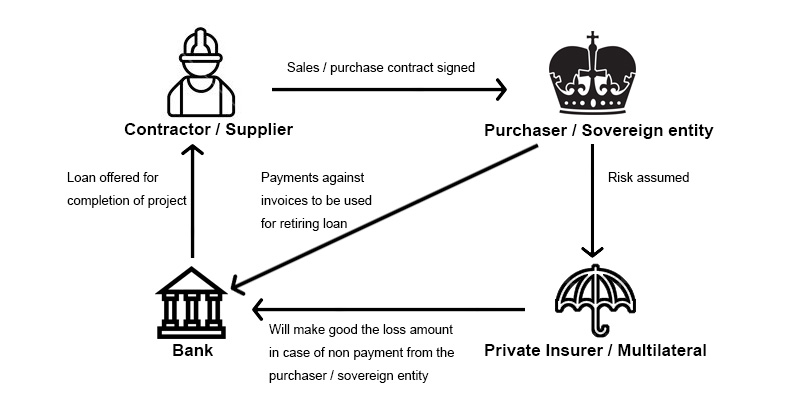

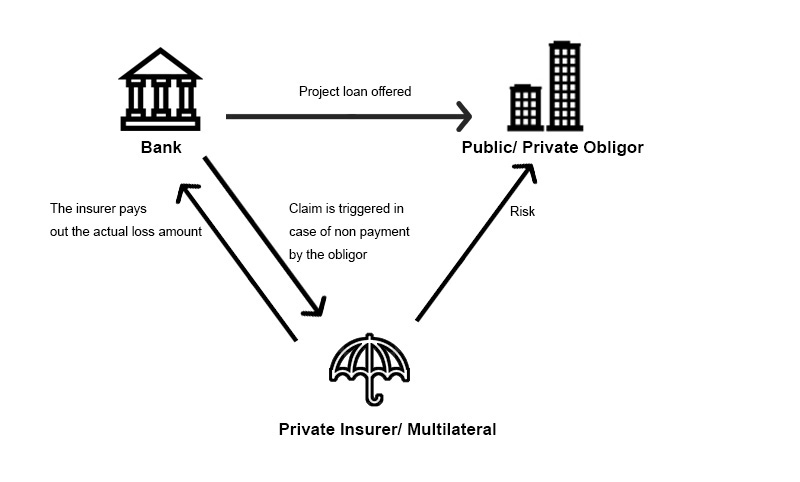

Where the obligor is the project owner itself

Where the obligor is the supplier / contractor